Why You Must FREEZE All Your Burial and Funeral Costs and How to Do It

By Richard Bruneau

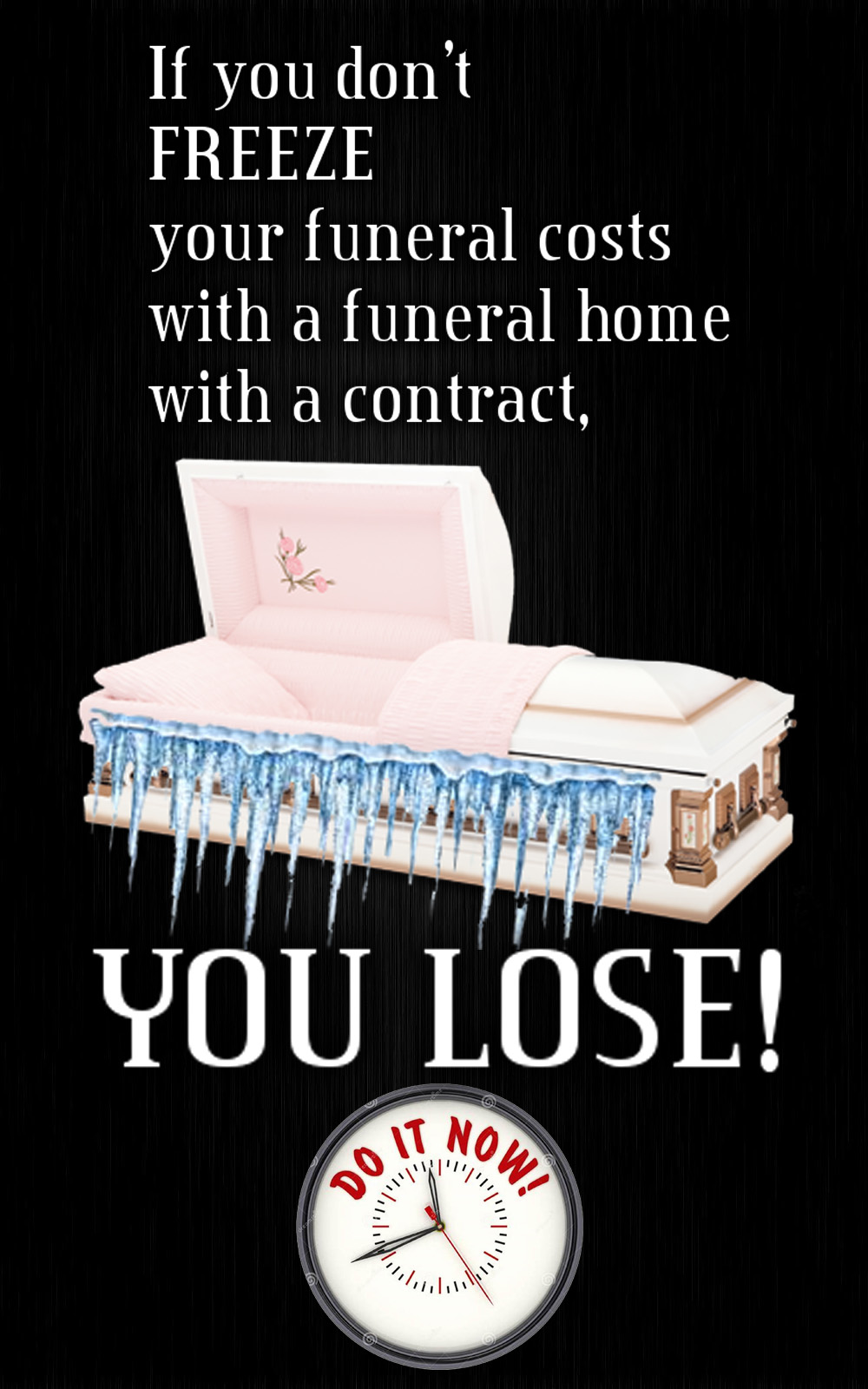

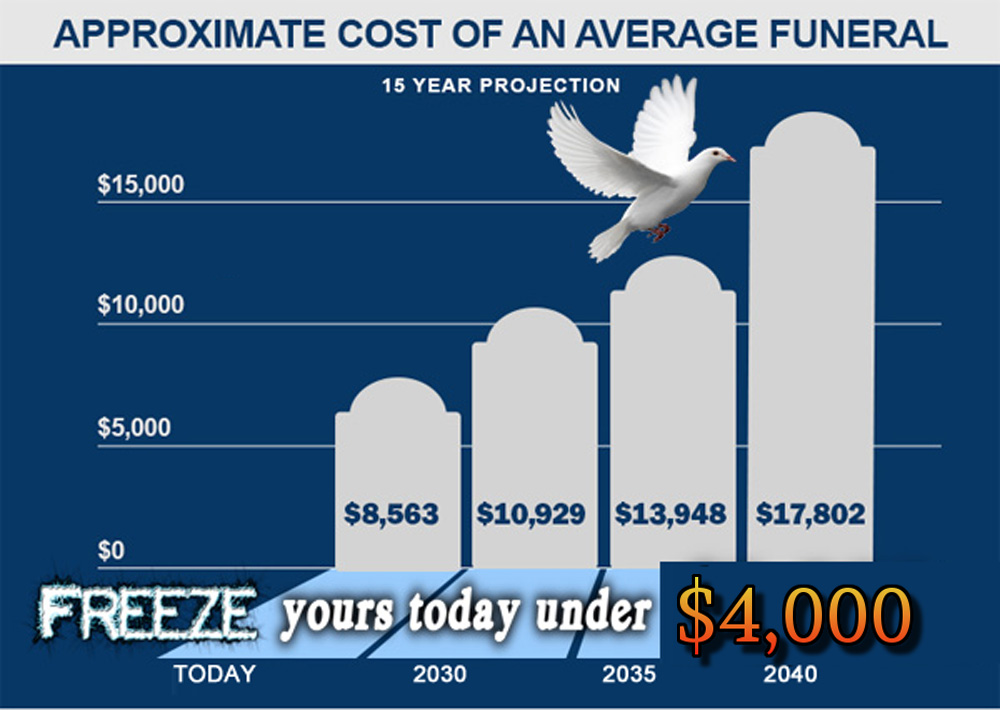

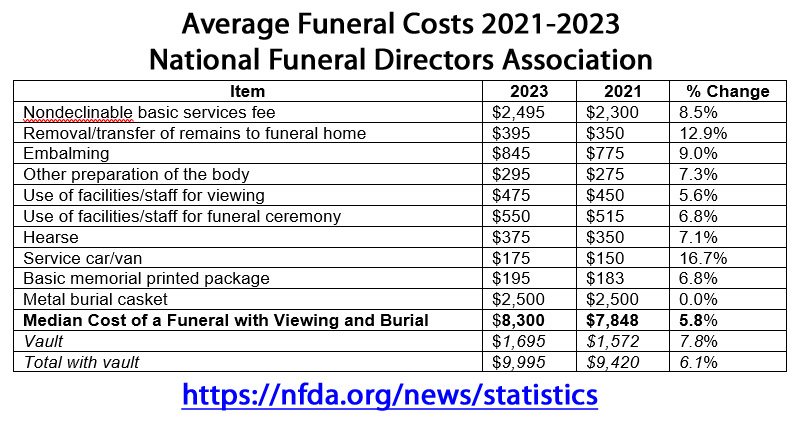

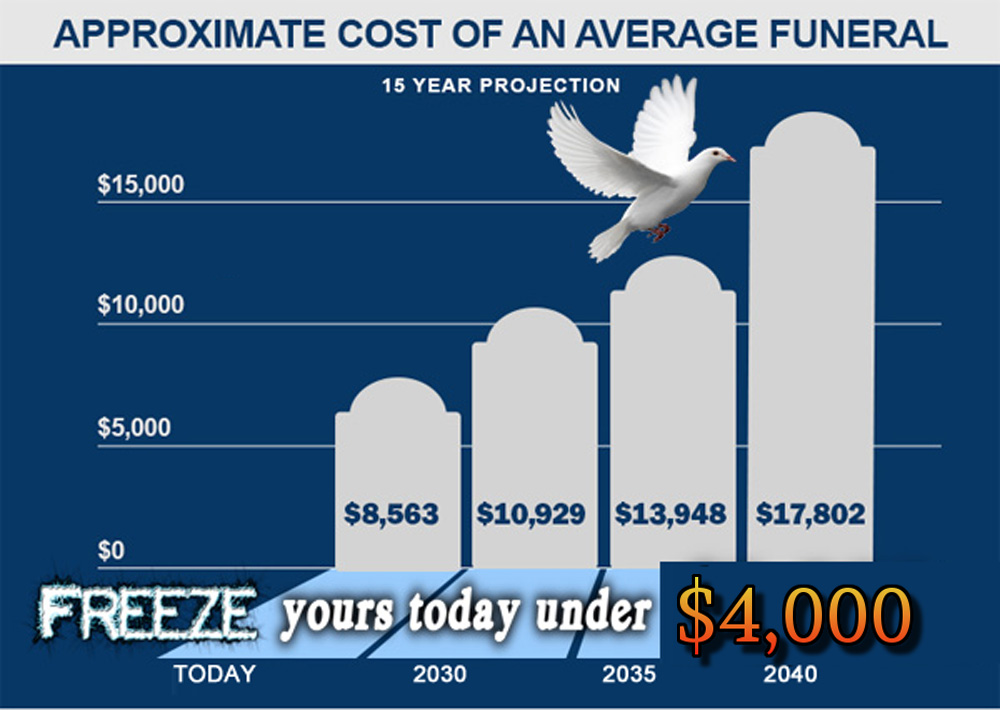

It is critical that you know how to “freeze” burial and funeral costs. Otherwise, your best “guesses" could betray you and cost you thousands, even tens of thousands of dollars more than it should have. A final expense life insurance agent, for example, could ignorantly offer a policy that provides $15,000 at the time of death, the amount you have both determined you need, and this will cost you $120 per month for the rest of your life. You are age 68 with decent health.

But if you live 10 years, you may or may not break even. After 120 months, or ten years, you premiums paid will be $14,400 to receive a fixed death benefit of $15,000. Nothing is factored in for inflation, so you will lose. If you live to be 82, you will pay $20,160 to get $15,000. If you live to be 85, you will pay $24,480. You can’t win with final expense whole life used this way. There is a better way.

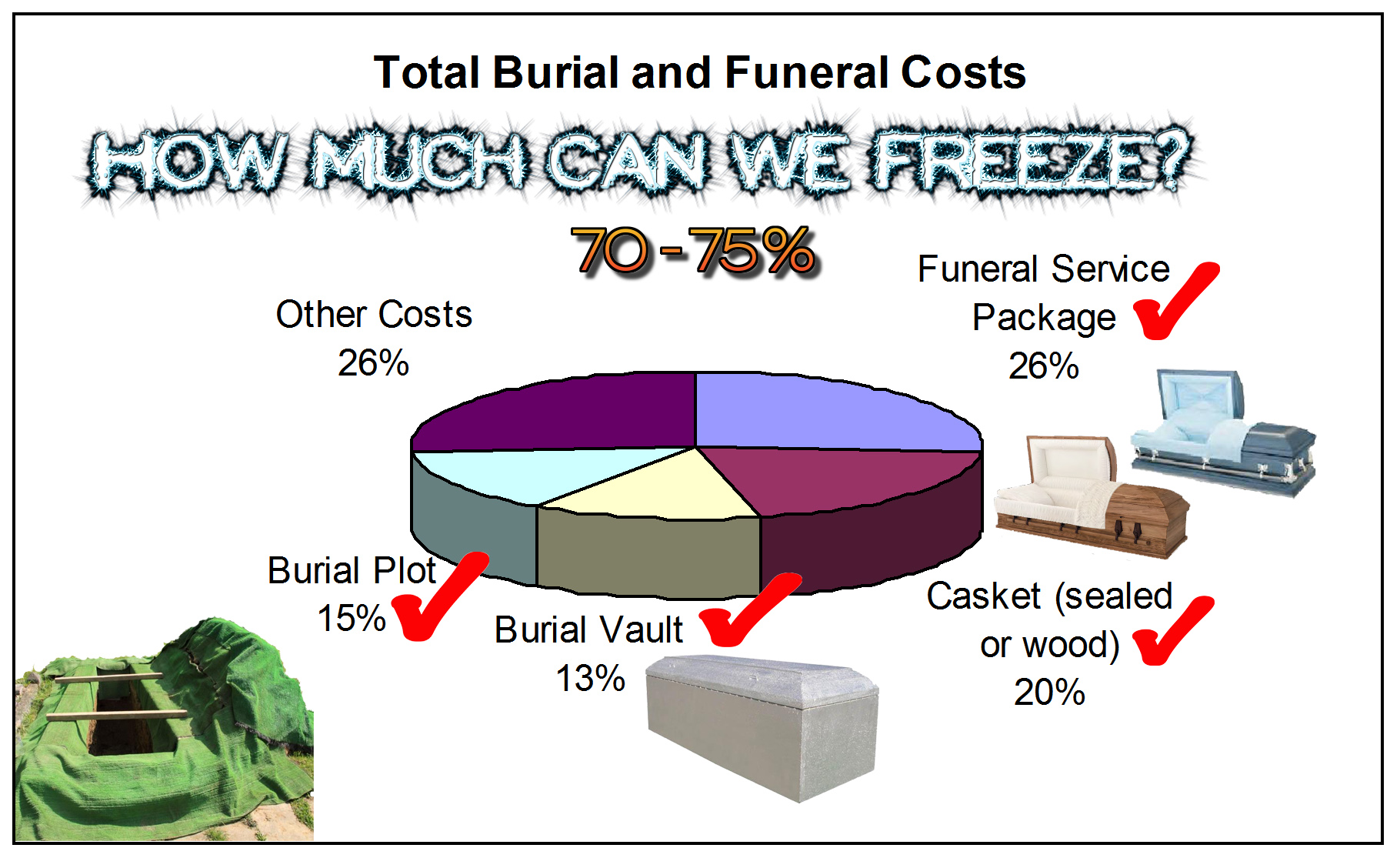

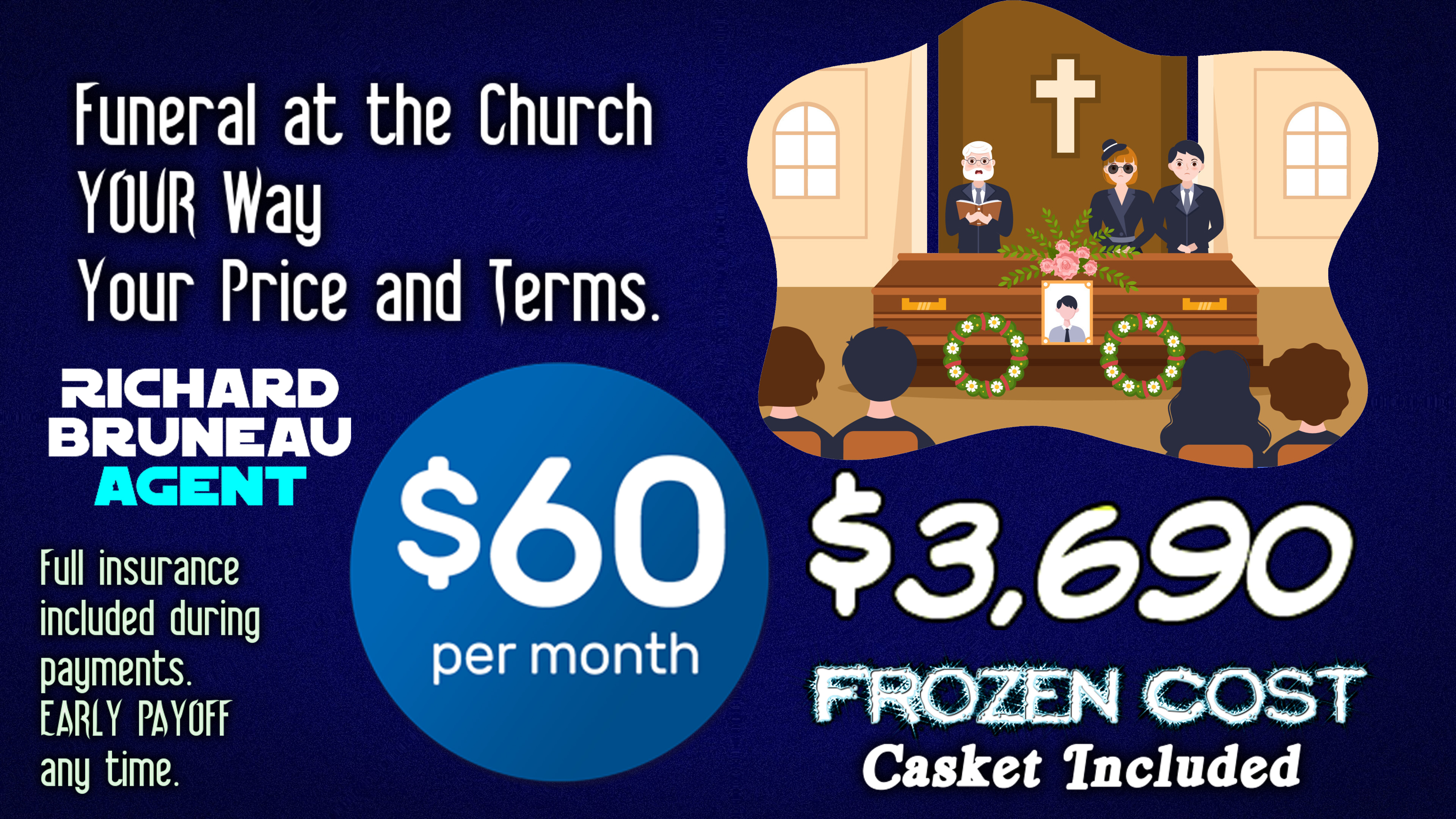

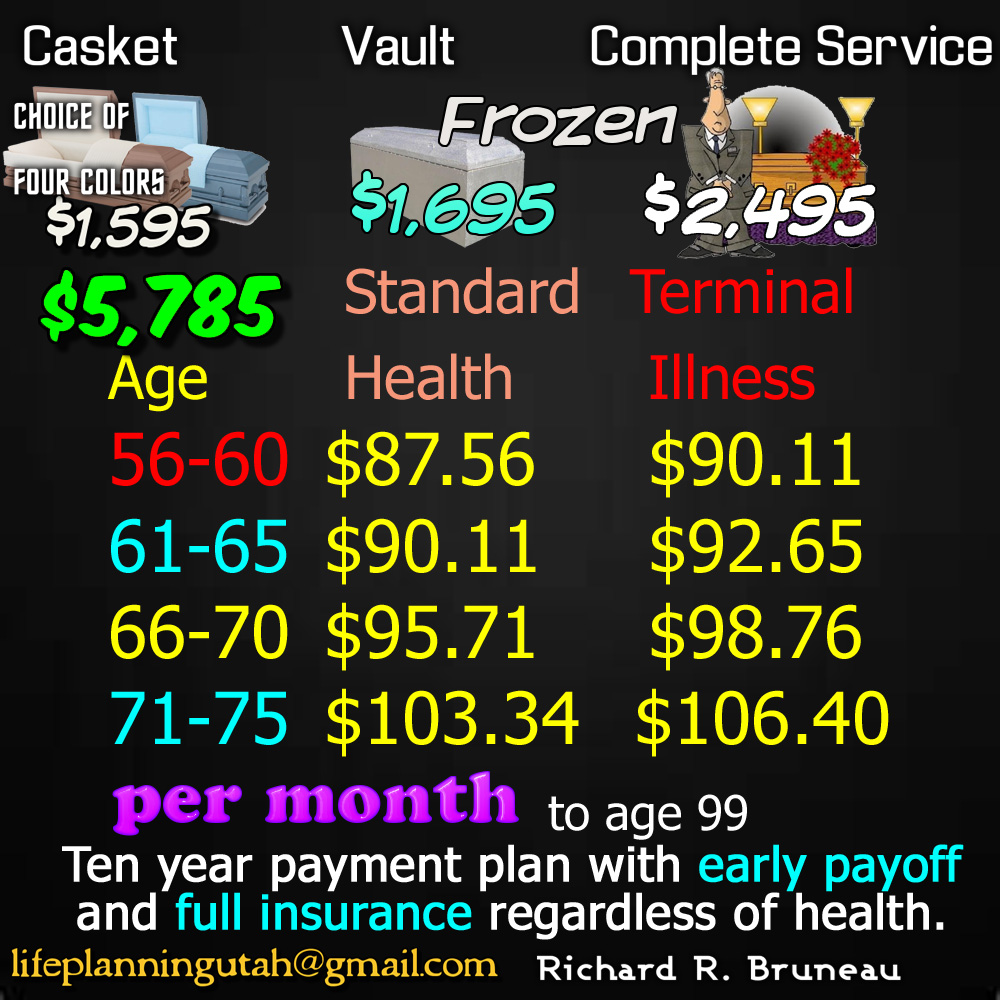

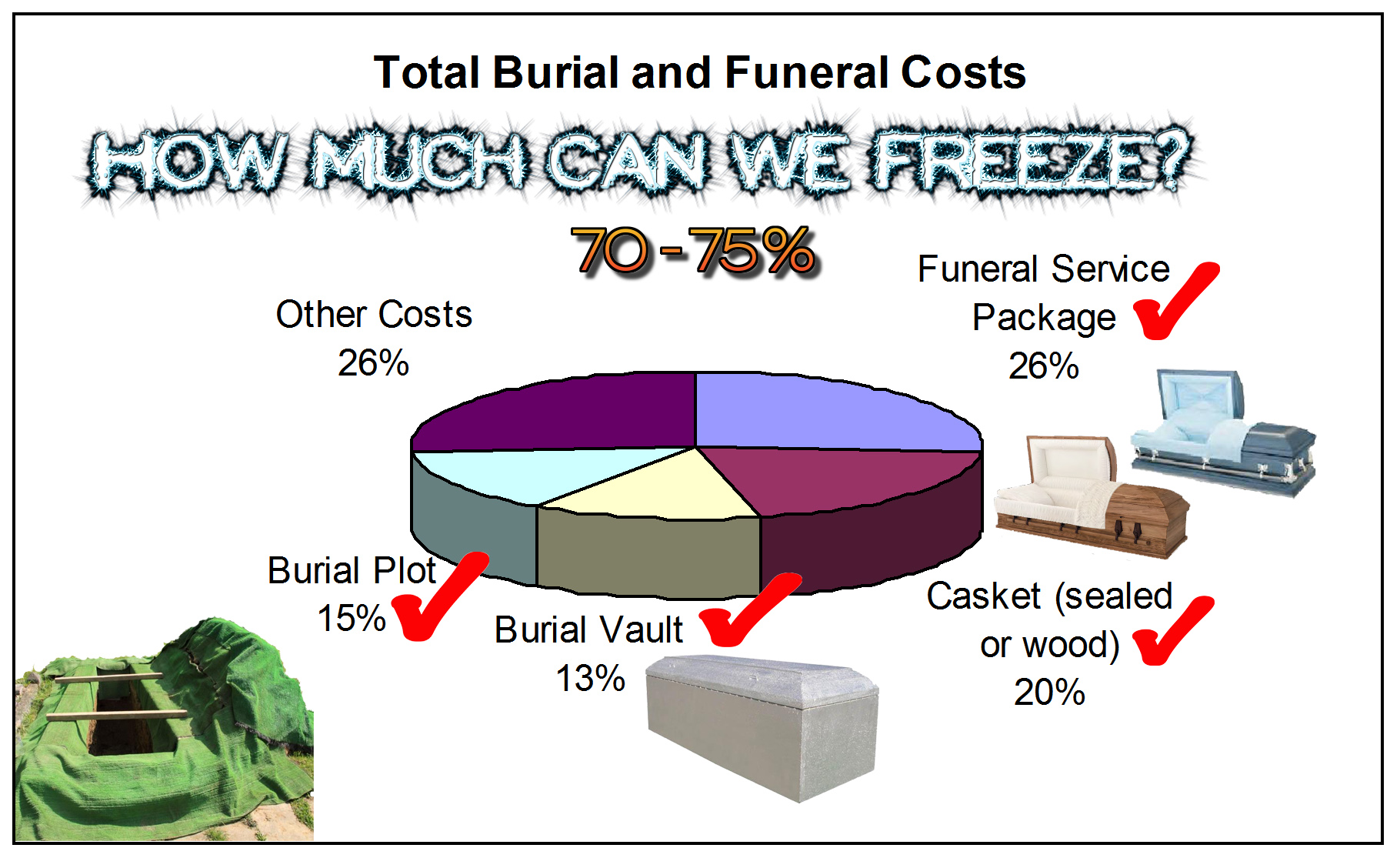

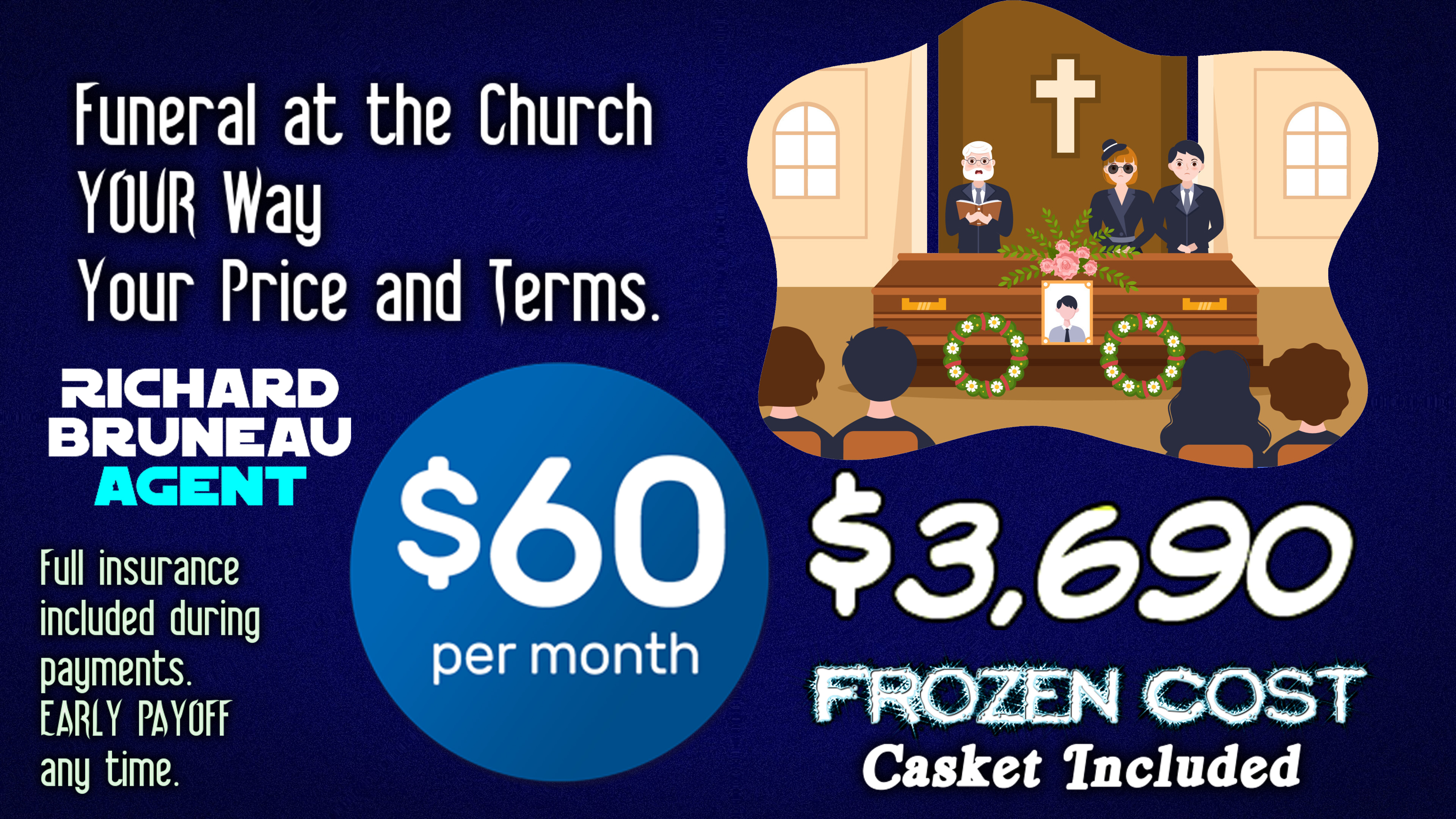

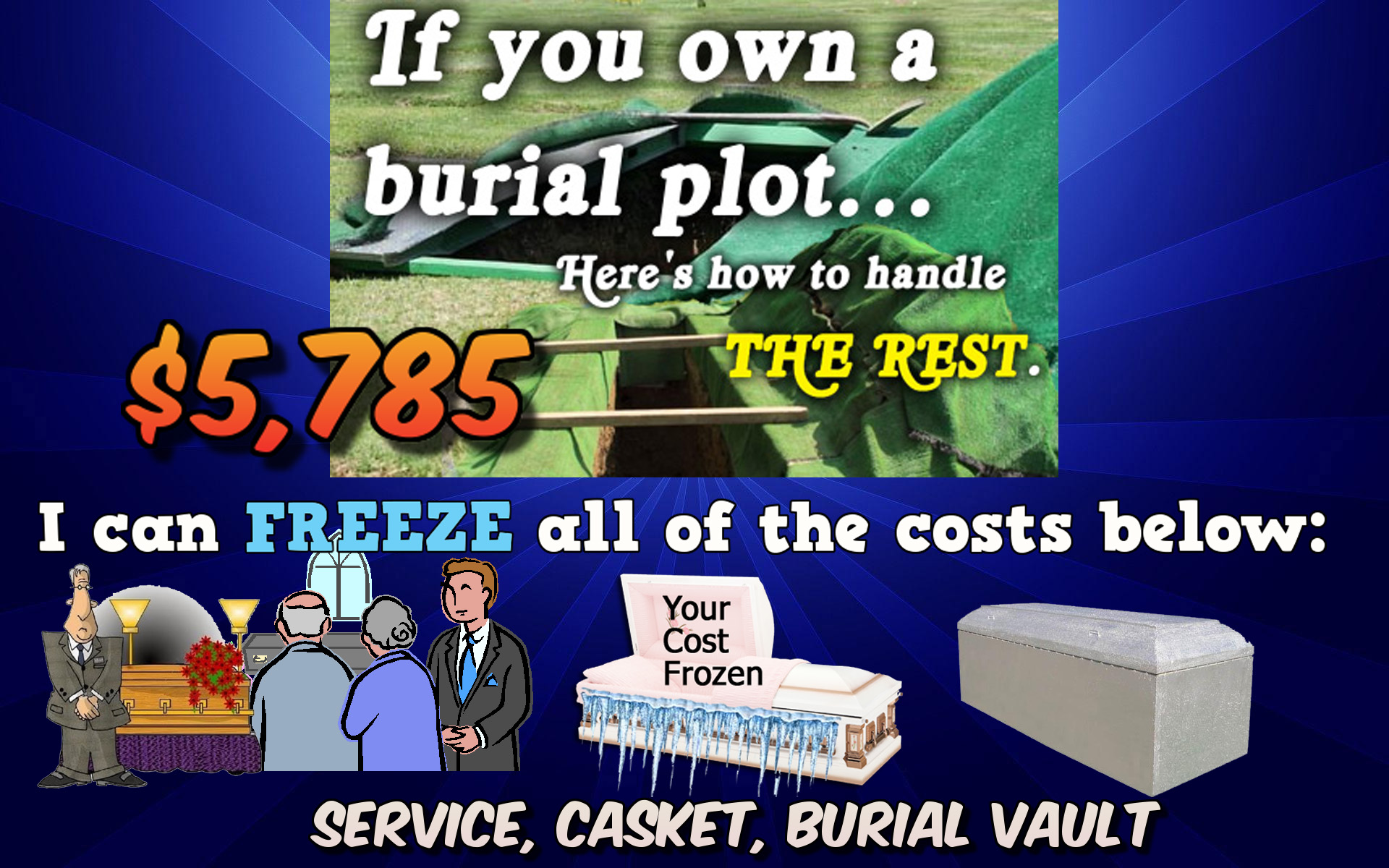

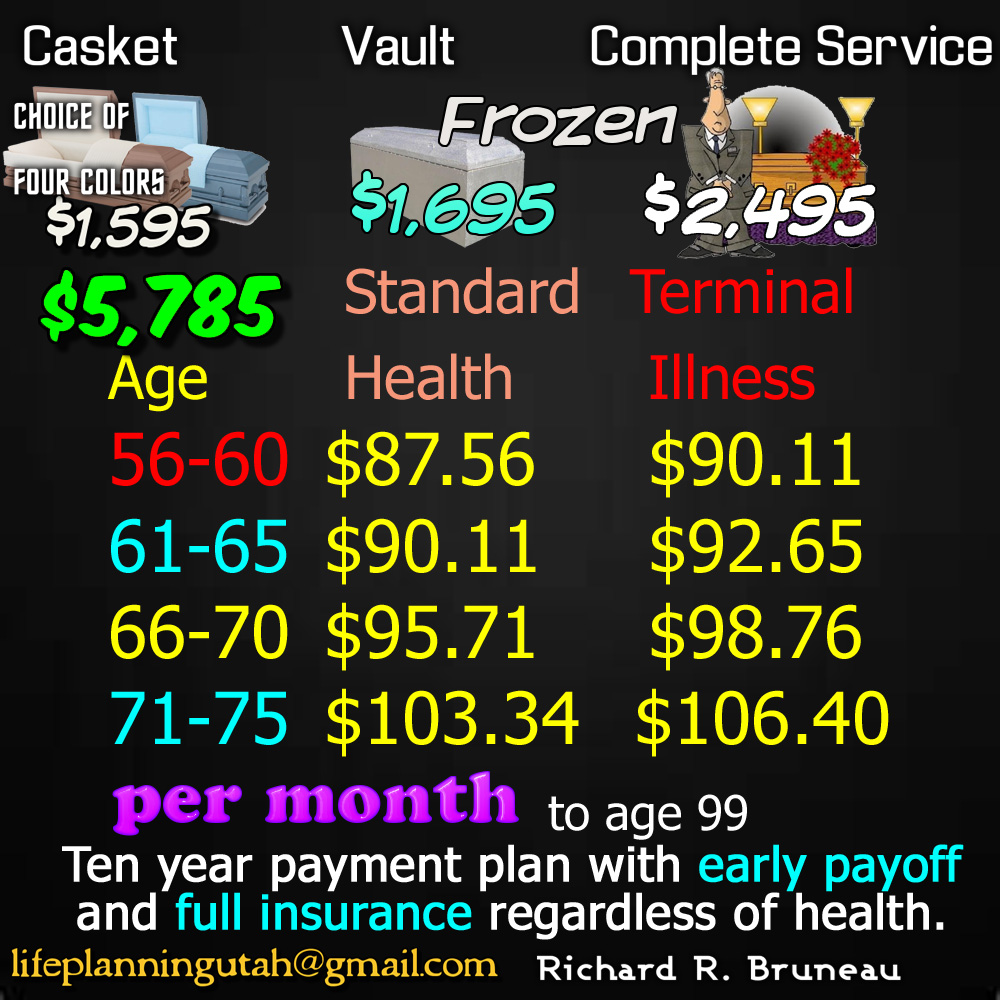

This is one reason funeral homes offer “pre-need" contracts, which “freeze" a large percentage of your total funeral and burial costs, regardless of future price increases, have monthly payments up to ten years, and have growing cash value for the rest of your life. The growing cash value is to cover both the guaranteed and estimated items in your plan. You don’t have to make payments your “whole life.” You are done in 10 years or less, whenever you decide. Then odds are good your total funeral and burial are paid with no money due at the time of death. If you are lucky, some money may be refunded.

But pre-need “total payout” can be very high over 10 years, especially at older ages and with health issues. So, on average, the total payout will be double today's costs. If you want $15,000 of death benefits with costs frozen, your payment at age 68 is $250 per month for 120 months, or $30,000. You can get burned with “guaranteed, pre-paid” plans with funeral home also. But there is a way to win.

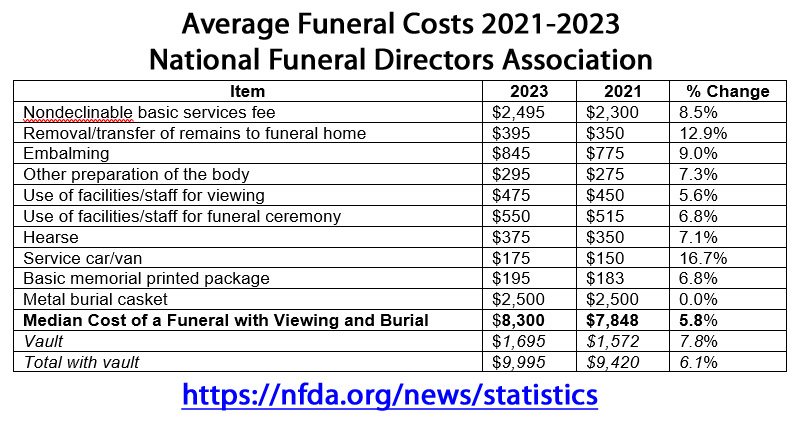

First, make sure the funeral home you select is the best value (lowest cost) for your money with about 150-200 miles of where you live. Choosing the right funeral home automatically tilts odds in your favor of cutting your total payout by thousands. Secondly, the best value funeral home should also not raise prices very often. This has the inflation factored licked. My number one choice is Premier Funeral Services, which serves the entire state of Utah at lowest cost. Stay away from chains, publicly-traded, and over-priced funeral homes.

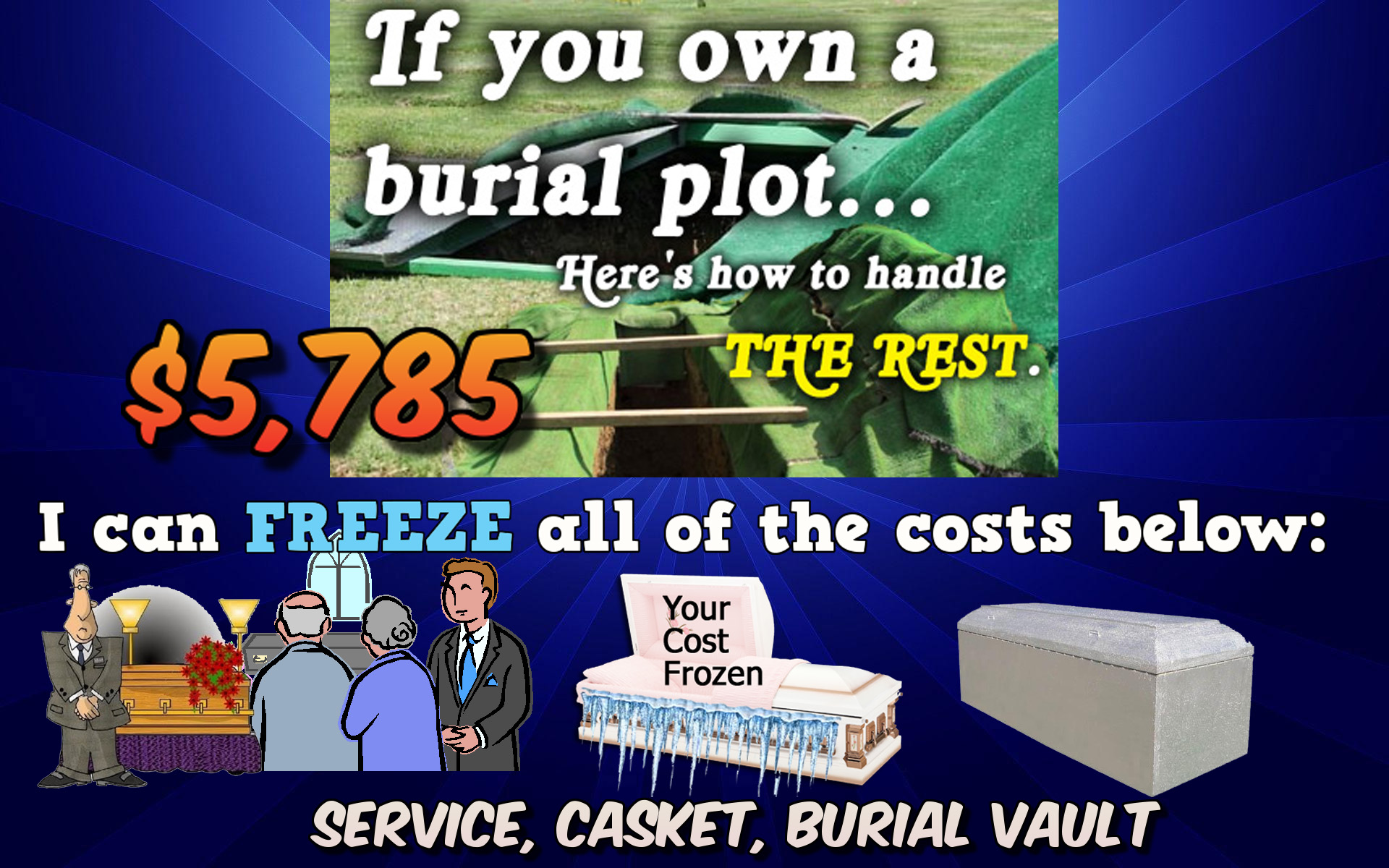

If you follow my recommendations and use Premier Funeral Services, a complete burial and funeral (burial plot already paid) will come to less than $9,000.

You have gone from expecting a total bill of $15,000 to $20,000 for everything to pre-paying around $8,000. And you cut your payments in half on any pre-need plan.

HOW CAN I WIN FOR SURE?

Here is the strategy. The answer to winning in the biggest way is to pay quickly, over about 3 or 4 years for the total amount you need. Use a funeral home’s pre-need plan and pay the plans off early. Other life insurance plans to pay for final expenses CANNOT be paid off early. You are stuck with payments for life.

With a funeral home’s pre-need plan, you can start with as little as little as $20 per month for a death benefit of $1,000 to $2,000 with many costs guaranteed. All you need to do is pay the plan off in one year, and you win. No cost for stretching payments out, because it is “same as cash." Paying off $2,000 in a year is not hard as $10,000. Then do it again next year, and the year after, maybe increasing the total to $3,000 or more.

I am one of the few agents in Utah who can ensure your total burial and funeral costs that have not yet been paid will only cost you around $8,000. If you leave it in the wrong hands, the total will easily be $15,000 to $25,000.

© copyright 2023| Richard R. Bruneau | all rights reserved