What is the Best Funeral Funding Product on the Market for Nearly Everyone?

By Richard Bruneau

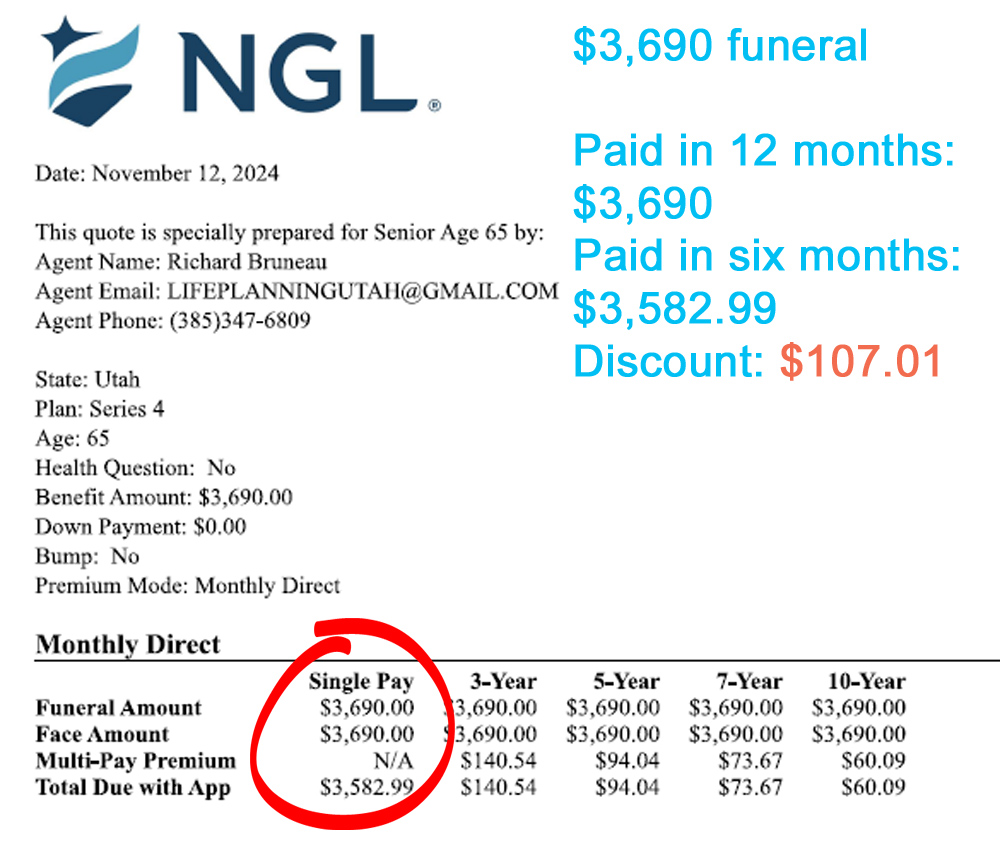

I have written approximately 900 final expense and “pre-need” plans to cover funerals, burials, and cremations in 30 years. About ten years ago, I needed to determine which was the best product for a client’s money in the United States. I came up with one product that I have used almost exclusively for twelve years.

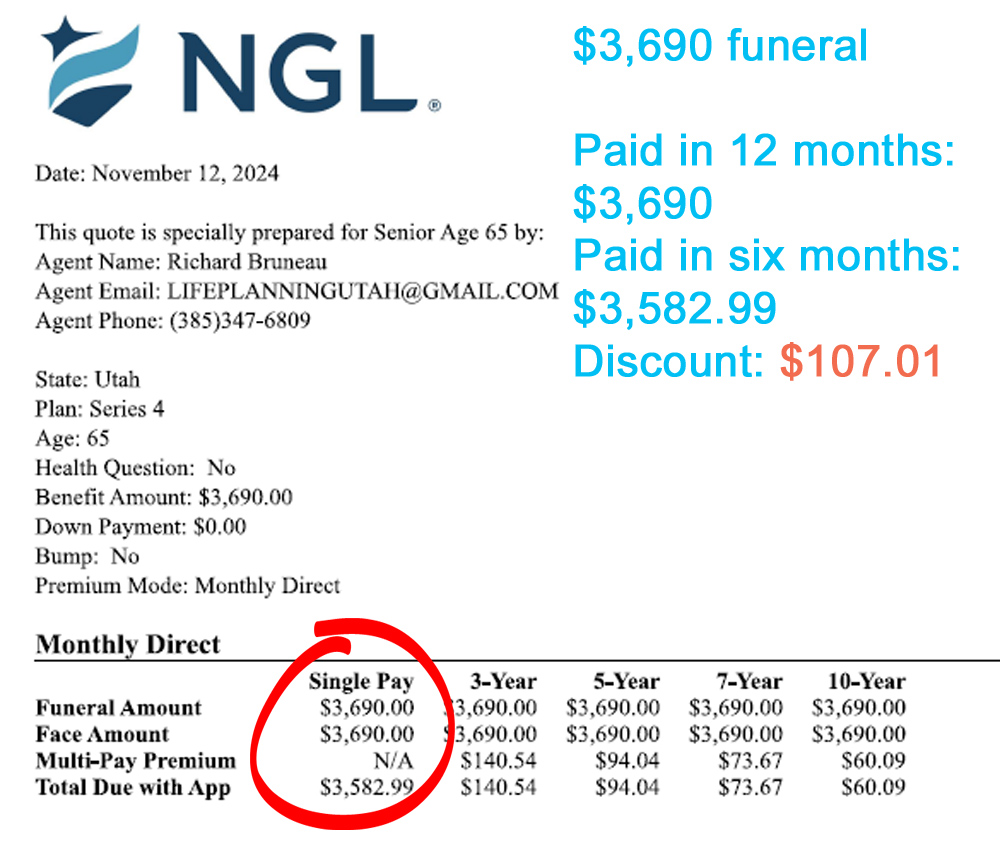

NGL Series 4 Preneed

NGL Series 4 Preneed

If You’ve Been Setting Aside Funeral Money

Many people in their senior years will “set aside” money for funeral and burial. Here are the reasons:

1. They don’t trust funeral homes. Even if they know about “pre-need” funding, they may not be decided on a funeral home. And they know many funeral homes over-charge, both in advance and at the time of need. On top of the high prices, they have been shown the high monthly payments on pre-need plans. So they’ll wait until they have all the money and take their time deciding on a funeral home.

2. They believe they will do better just “investing” their money. They believe that somehow they will come out way ahead choosing investments to switch in and out of.

3. They can’t qualify for life insurance. Keeping money set aside for when the time comes makes sense to them.

4. They’ve had health issues, and final expense life, even “guaranteed issue,” is too expensive, and they don’t want to make that high payment the rest of their lives.

5. They want their precious money hidden, especially in cases where they are applying for Medicaid.

6. Other reasons.

© copyright 2024| Richard R. Bruneau | all rights reserved